Hey friends,

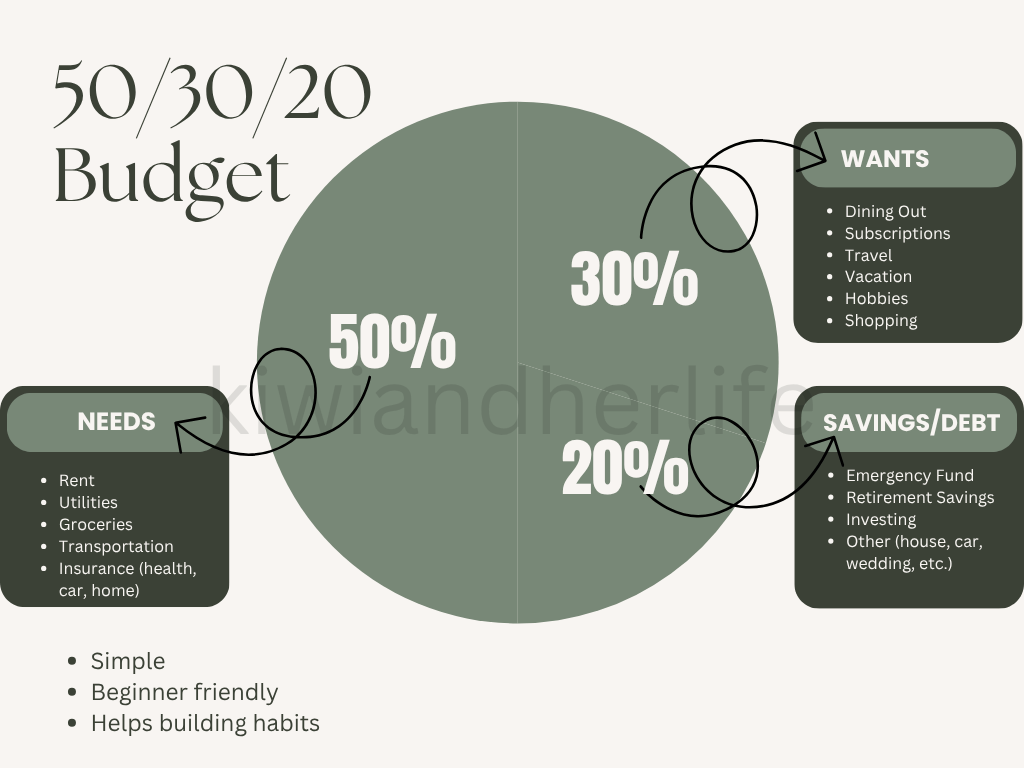

Managing your finances does not have to be complicated. In fact, when I started budgeting I used one of the simplest and most effective ways to do so – the 50/30/20 budget rule. This method breaks down the after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. It is a flexible approach that works whether you are a budgeting beginner or just looking to bring more balance to your spending.

- Needs (50%): These are the things you must pay to keep your life running, like rent/mortgage, groceries, utilities, insurance, and transportation. It also includes minimum payments on debt, such as student loans or credit cards. If your needs take up more than half of your income, it is a sign to reevaluate housing costs or explore ways to cut back on expenses in other areas.

- Wants (30%): This category includes all the extras that make life enjoyable, such as dining out, entertainment, subscriptions, travel, hobbies, and shopping. While these expenses are not essential, they are important for quality of life. The key here is moderation: Enjoying these things without letting them derail your financial goals.

- Savings and debt repayment (20%): This is your future-focused money. It includes building an emergency fund, contributing to retirement accounts, investing, or making extra payments toward loans. Prioritizing this category ensures you’re not just living for today but also planning for tomorrow.

For example, if your monthly take-home income is $3,000, your budget would allocate $1,500 for needs, $900 for wants, and $600 for savings and debt repayment. Of course, these percentages are just guidelines. Life happens, and some months do require adjustments, but sticking close to the 50/30/20 rule builds strong financial habits over time.

What makes the 50/30/20 rule so popular?

Simplicity. You do not need to track every penny or spend hours crunching numbers. It gives you enough structure to stay in control while still leaving room for flexibility. And perhaps most importantly, it teaches balance by making sure you are not overspending in one area at the expense of another.

Why Budgeting?

At its core, budgeting isn’t about restriction but about freedom. When you know where your money is going, you can make more intentional choices, reduce stress, and work toward the life you truly want. The 50/30/20 rule offers a realistic and sustainable starting point without overcomplicating the process.

How to start Budgeting using the 50/30/20 Budget:

- Calculate Your After-Tax Income: Start by figuring out how much money you actually take home each month after taxes and deductions. This is your real spending money.

- Break It Down Using the 50/30/20 Rule: Split your income into three simple categories: 50% for Needs, 30% for Wants, 20% for Savings & Debt Repayment.

- Track Your Spending: Before you can follow any budget, you need to know where your money is actually going. Look at your bank statements, credit card activity, or receipts for the past 1–2 months. Write down, print out, and categorize every expense. I like to color code. You can use red for needs, yellow for wants, and green for saving & debt repayment. This step helps to spot patterns.

- Compare and Adjust: Once you’ve tracked your spending, compare it to the 50/30/20 breakdown. Are you spending too much on wants? Not saving enough? Now you know what to adjust. Make small changes that feel realistic, like cooking at home a few more nights a week or setting an automatic transfer to savings every time you get paid.

- Roll With the Punches: Life happens and expenses change. If they do, your budget should also change. Check in once a month to review your spending, update your categories, and make sure you’re still on track. This will help you stay consistent and make smarter money choices over time.

*I am not a financial professional. The information provided in this blog post is for general informational and educational purposes only. It is not intended as financial or investment advice and should not be considered as such. Always consult with a qualified financial advisor or professional before making any financial decisions. Any action you take based on this content is at your own risk.

Until next time,

– K.

Leave a comment